1. Introduction

The global electrical home appliances market is at a transformative crossroads as artificial intelligence (AI) integration becomes a core feature for innovation, usability, and energy efficiency. This report examines the state of AI-enabled electrical home appliances in 2025 and presents forecasts for the next 3–5 years (up to 2030), with an emphasis on products integrating smart connectivity, predictive algorithms, and cutting-edge automation.

Over the past several years, technological advancements such as Wi-Fi connectivity, real-time sensor monitoring, and machine learning have reshaped how manufacturers design, manufacture, and market home appliances. Major companies—for example, GE Appliances and Signature Kitchen Suite—have introduced intelligent systems with features like guided cooking, auto-sensing mixers, and dynamic wash/dry cycle adaptations. As these companies continue pushing updates that improve performance via over-the-air software enhancements, the integration of AI into everyday appliances is rapidly moving from luxury to mainstream.

This report aims to provide a comprehensive, data-rich review of current market trends, technological innovations, regional market dynamics, and forecast information. It also presents strategic recommendations for manufacturers and stakeholders to successfully capture opportunities over the next 3–5 years.

2. Market Overview & Current Trends

The global home appliances market was valued at approximately USD 711.36 billion in 2024 and is set to surge as new technology drives consumer demand. With energy efficiency regulations tightening and lifestyles evolving, smart—and in particular AI-enabled—electrical appliances are emerging as a dominant segment. Projections indicate that the market could surpass USD 1.11 trillion by 2033 with a compound annual growth rate (CAGR) in the range of 5.1% to 7.1%.

Key Observations

- Technological Integration: Manufacturers are embedding sensors, wireless connectivity (Wi-Fi, Bluetooth), and real-time software updates in appliances. These features enable appliances to “learn” from user behavior and optimize performance automatically.

- Ecosystem Connectivity: Products increasingly integrate into broader smart home ecosystems via mobile apps and digital platforms (e.g., GE ThinQ® and LG SmartThinQ®), enabling consumers to control, monitor, and receive diagnostic updates remotely.

- Energy Efficiency and Sustainability: Government and regional regulations, such as the European Union’s new energy labeling standards, are forcing manufacturers to design energy-efficient products. AI systems further optimize energy use by dynamically adapting to usage patterns and ambient conditions.

The convergence of these trends not only reshapes technology portfolios, but also paves the way for a more personalized, connected, and intelligent residential experience.

3. AI-Driven Product Innovations and Examples

One of the most notable aspects of market transformation is the advent of AI-driven product innovations. Manufacturers are leveraging AI to enhance functionality and convenience while improving energy management. The following table provides illustrative examples of how AI features are implemented in various product categories.

| Product Category | AI-Enabled Feature | Real-World Example |

|---|---|---|

| Smart Ovens | Cookcam™ AI, Gourmet AI™ | Wall ovens equipped with in-oven cameras that detect, identify food items, and adjust cooking time and temperature automatically |

| Refrigerators | Adaptive SmartDispense, AI Inventory Tracking | GE Profile refrigerators that monitor inventory and adjust temperature settings based on sensor data |

| Laundry Systems | AI Wash/Dry Cycle Optimization | GE Profile UltraFast Combo models featuring AI-powered wash and dry cycles that adjust parameters based on fabric type and soil levels |

| Indoor Smokers | Active Smoke Filtration with Real-Time Adjustment | The GE Profile Smart Indoor Smoker that employs sensors to convert real wood smoke into flavor-packed warm air |

| Cooking Appliances | Guided Cooking, Recipe Suggestion Algorithms | Appliances that combine professional recipes with sensor readouts for perfect consistency, as practiced by GE’s latest range |

Additional Product Details

- Smart Ovens:

AI-powered ovens now offer features that recognize the type of food being cooked. For instance, GE’s Cookcam™ AI in select wall ovens uses real-time imagery to detect the food item, automatically adjusting cook time and temperature to achieve optimal results. These ovens also provide guided cooking, which can deliver step-by-step instructions directly to the consumer’s smartphone. - Refrigerators:

Connected appliances, such as AI-enhanced refrigerators, go beyond conventional ice and water dispenser features. They now include sensor-based technologies that can track the content of the refrigerator. This information allows for real-time temperature adjustments, automated ordering suggestions based on inventory levels, and reducing food waste by monitoring expiration dates. - Laundry Systems:

The integration of conversational AI via smart apps provides a user-friendly experience in modern laundry systems. These appliances not only detect fabric textures through motor torque feedback, but also suggest the most suitable wash cycles for different loads, thereby prolonging appliance life and optimizing water and energy consumption. - Indoor Smokers and Mixers:

Indoor smokers are now equipped with advanced filtration systems that adjust smoke density and flavor intensity using real-time sensor feedback. Likewise, smart mixers that feature Auto Sense technology monitor changes in texture and viscosity, ensuring ideal mixing without over- or under-preparation.

Visualization with Mermaid Diagram

Below is a Mermaid diagram that illustrates the process of how AI integration transforms a conventional appliance into a smart, self-learning device:

flowchart LR

A["User Interaction"] --> B["Data Collection via Sensors"]

B --> C["AI Data Analysis"]

C --> D["Predictive Adjustments"]

D --> E["Real-Time Appliance Optimization"]

E --> F["Enhanced User Experience"]

C --> G["Energy Efficiency Measures"]

G --> F

F --> H["Continuous Software Updates"]

H --> BIn this flow, sensors collect data from user interactions and appliance conditions. AI analysis processes this data to make real-time, predictive adjustments that optimize performance and energy usage. Furthermore, continuous software updates ensure that appliances improve over time with evolving consumer habits.

4. Regional Market Dynamics

The growth of AI-enabled electrical home appliances does not occur uniformly across the globe. Instead, regional influences strongly affect market penetration, consumer preferences, and innovation pace. Below is an analysis by region.

Regional Performance Breakdown

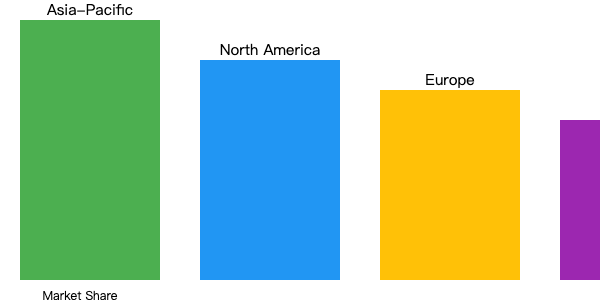

| Region | Approximate Market Share (2023) | Key Growth Drivers |

|---|---|---|

| Asia-Pacific | ~38% | Urbanization, rising middle-class incomes (especially in China and India), and rapid development of smart cities |

| North America | ~22% | High smart home penetration, premium appliance demand, and strong consumer disposable income |

| Europe | ~18% | Stringent energy regulations, high consumer awareness of sustainable products, and steady IoT adoption |

| Middle East/Africa | Emerging with CAGR ~7.7% | Increasing urbanization, growing youth population, and escalating replacement sales due to aging appliances |

Further Regional Insights

- Asia-Pacific:

This region leads not only in the production of electrical appliances but also in rapid consumer adoption. Countries like China and India have witnessed exponential growth in urbanization. For instance, the United Nations projects that by 2050, 68% of the global population may reside in urban areas. This has been a significant driver for smart appliance sales, as densely populated urban centers demand energy-efficient and technologically advanced appliances. - North America:

North America, especially the United States, remains a mature market. The region benefits from high levels of disposable income and a strong preference for premium, connected home appliances. Despite its maturity, innovations continue to drive replacement cycles, with consumers willing to upgrade to the latest, AI-driven models to enhance convenience and sustainability. - Europe:

In Europe, consumer demand is heavily shaped by environmental regulations. The European Union’s Energy Labeling Directive, which employs a more rigorous A–G rating system for energy efficiency, has prompted manufacturers to invest in eco-friendly AI appliances. This region remains on the cutting edge of integrating AI with traditional functions to achieve lower energy consumption. - Middle East & Africa:

Although smaller in market share, this region is experiencing rapid growth due to urbanization and a tech-savvy younger demographic. Manufacturers are recognizing the need to tailor energy-efficient and robust AI solutions to meet the challenges posed by extreme weather conditions and intermittent infrastructure limitations.

Visualization – Regional Comparison Chart (SVG Diagram)

Below is an SVG diagram intended to visually compare key regional factors influencing market growth:

Explanation:

- The diagram uses differently sized bars to represent estimated market shares and key growth drivers across Asia-Pacific, North America, Europe, and the Middle East & Africa (MENA).

- Asia-Pacific leads with the largest share, followed by North America and then Europe. MENA is depicted with a smaller share but notable potential for rapid growth.

5. Key Market Drivers

The surge in the adoption of AI-enabled appliances is driven by several converging factors. In this section, we discuss the most critical market drivers.

5.1 Energy Efficiency and Sustainability

- Stringent Regulations: Regions like the European Union have implemented strict energy labelling systems, pushing manufacturers toward energy-saving innovations. For example, the EU directive requires significant energy efficiency improvements, which is driving a shift to inverter motors and smart sensor-regulated operations.

- Consumer Consciousness: A growing number of consumers now consider energy efficiency a key purchasing factor. Approximately 65% of buyers are inclined to invest in appliances marked as ENERGY STAR® certified, further boosting the market for AI-enabled, energy-optimized products.

- Technological Breakthroughs: Manufacturers integrate machine learning algorithms to predict energy consumption patterns. This not only reduces electricity bills but also contributes to overall environmental sustainability.

5.2 Integration within the Smart Home Ecosystem

- Connectivity and IoT: Today’s appliances are no longer stand-alone products. Instead, they form a part of a larger smart home network where devices communicate via Wi-Fi or Bluetooth. AI-driven functionalities include remote monitoring, predictive maintenance alerts, and real-time control via mobile apps.

- Cross-Platform Compatibility: Partnerships between appliance manufacturers and tech ecosystems (such as Instacart, Sonos, and other IoT platforms) offer seamless integration. For instance, GE ThinQ® enables consumers to adjust settings remotely and receive alerts, ensuring appliances work optimally even when users are away from home.

- User Experience Enhancement: The combination of intuitive interfaces and AI algorithms provides consumers with personalized recommendations, such as recipe suggestions and cycle optimizations, yielding a heightened level of control and automation in daily routines.

5.3 Urbanization and Rising Disposable Incomes

- Urban Growth: Rapid urbanization, particularly in emerging economies such as China and India, has escalated the demand for compact, multifunctional, and energy-efficient appliances suited to high-density living environments. Urban centers are not only expanding in size but also becoming more technologically advanced, where smart homes are the norm rather than the exception.

- Increased Purchasing Power: As disposable incomes rise globally, consumers are more willing to invest in modern appliances that offer both functional benefits and long-term cost savings. Data shows that even in traditionally price-sensitive markets, there is an increasing trend toward the adoption of premium products featuring AI-driven innovations.

Visualization – Key Drivers Table

| Driver | Description | Implication |

|---|---|---|

| Energy Efficiency | Adoption of inverter technology, smart sensors, and energy optimization based on AI-driven predictions | Reduced electricity consumption by up to 40% |

| Smart Home Ecosystem Integration | Seamless connectivity with IoT platforms and remote control via mobile applications | Enhanced user convenience and operational efficiency |

| Urbanization | Rapid urban growth leading to a concentrated demand for versatile, space-efficient appliances | Expansion of market in densely populated urban areas |

| Rising Disposable Income | Increased consumer purchasing power influencing a shift towards premium appliances | Elevated sales in high-end segments |

6. Challenges and Restraints

While the adoption of AI-enabled electrical home appliances offers significant growth opportunities, the market also faces several challenges that could restrain widespread adoption.

6.1 High Initial Investment Costs

- Price Premium: AI features often add a 30–50% premium to the base price of appliances. Many consumers, especially in price-sensitive segments and emerging markets, may hesitate to adopt these models without assurance of long-term savings.

- Financing Models: Although EMI plans and lease-to-own options exist, high upfront costs can be a barrier, particularly when compared to traditional models with lower initial pricing.

6.2 Supply Chain Disruptions and Production Delays

- Global Manufacturing Challenges: Recent events have shown that supply chain disruptions can result in production delays of up to 15% during 2023–2024. Manufacturers are increasingly investing in localized production solutions to mitigate these risks.

- Component Shortages: Rapid technological advancements in sensors, chips, and connectivity modules may lead to shortages, impacting the timely delivery of AI-enabled features.

6.3 Data Privacy and Security Concerns

- User Concerns: With AI appliances gathering extensive data from user interactions, privacy and data security remain a major concern, with as many as 40% of potential users hesitating to adopt IoT-based appliances.

- Regulatory Compliance: Manufacturers must navigate diverse regulatory environments (e.g., GDPR in Europe) and invest in robust data encryption methods, which in turn may increase costs.

Visualization – Challenges & Restraints Table

| Challenge | Impact | Potential Mitigation Strategies |

|---|---|---|

| High Initial Investment Costs | Increased appliance price by approximately 30–50% relative to conventional models | EMI/lease-to-own financing, government subsidies |

| Supply Chain Disruptions | Production delays affecting 15% of manufacturers during periods of global instability | Localized manufacturing, diversified supplier portfolios |

| Data Privacy Concerns | Reduced consumer adoption due to lack of trust in data security and privacy safeguards | Adoption of GDPR-compliant protocols and advanced encryption methods |

7. Market Forecast and Segmentation (2025–2030)

The forecast for the AI-enabled electrical home appliances market is promising. Detailed analyses of product segments and growth projections are outlined below.

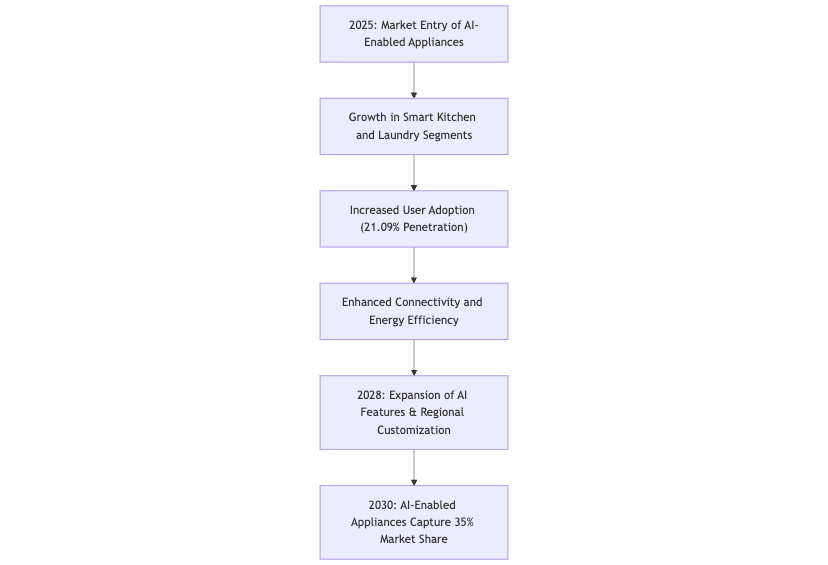

7.1 Global Market Size Projections

Forecasts indicate that the global home appliances market will grow from approximately USD 747.64 billion in 2025 to over USD 1.11 trillion by 2030. Within this market, the share of AI-enabled appliances is expected to expand significantly—from about 18% in 2025 to an estimated 35% by 2030.

| Year | Global Market Size (USD) | AI-Enabled Appliance Share |

|---|---|---|

| 2025 | 747.64 Billion | 18% |

| 2028 | 920 Billion | 28% |

| 2030 | 1.11 Trillion | 35% |

7.2 Segment Growth Trends

- Smart Kitchen Appliances:

- Features like AI-integrated smart ovens and refrigerators are expected to see a CAGR of nearly 9.2% between 2025 and 2030.

- Innovations such as guided cooking and inventory optimization are driving consumer preference for these appliances.

- Laundry Systems:

- AI-driven wash/dry cycles and fabric-sensitive sensors are projected to penetrate 85% of premium market segments by 2028.

- Connectivity through mobile apps offering real-time insights is becoming a key value addition.

- Refrigeration:

- AI-enhanced inventory management can reduce food waste by an estimated 20%–25%, further boosting customer interest in smarter, more efficient appliances.

7.3 Technology Adoption Rates

According to industry sources, global smart home penetration is set to reach approximately 21.09% by 2025. This figure is projected to increase steadily in tandem with the rollout of new AI features and greater consumer acceptance of connected systems.

7.4 Factors Contributing to Growth

- Rapid Urbanization: The projected increase in urban populations—especially in Asia-Pacific—ensures a continued drive toward compact, multifunctional appliances that combine convenience with efficiency.

- Rising Disposable Incomes: As consumers shift toward premium product segments, AI-enabled features are emerging as a decisive factor in appliance purchase decisions.

- Innovation and R&D Investments: Manufacturers’ continued commitment to technology innovation is narrowing the cost differential between conventional and smart appliances, thereby accelerating market adoption.

Visualization – Forecast Growth Overview (Mermaid Timeline)

Explanation:

This flowchart outlines key milestones from initial market entry in 2025, highlighting the growth in specialized segments, increased adoption, and continuous enhancement in connectivity and energy efficiency—all converging to drive significant market capture by 2030.

8. Strategic Recommendations

For manufacturers, retailers, and other stakeholders aiming to harness the potential of AI-enabled electrical home appliances, the following strategic recommendations should be considered:

8.1 Enhance Research and Development (R&D)

- Edge AI Solutions: Invest in edge computing technologies to facilitate offline functionality even without constant internet connectivity. This ensures reliable operations in regions with intermittent connectivity.

- Continuous Software Updates: Emphasize over-the-air updates to deliver new features and address security vulnerabilities. Manufacturers such as GE are already demonstrating the benefits of upgrading product capabilities over time.

8.2 Customize Products Regionally

- Tailored Solutions: Develop models that cater to local conditions—for example, humidity-resistant designs for tropical markets or energy-optimized appliances for regions with steep electricity tariffs.

- Localized Production: Address potential supply chain disruptions by incorporating localized manufacturing strategies. Initiatives such as BSH’s facility expansion in Egypt serve as examples of successful regional adaptation.

8.3 Strengthen Strategic Partnerships

- Ecosystem Integration: Collaborate with IoT platform providers and other technology partners (e.g., Instacart, Sonos) to ensure seamless integration of appliances into the broader smart home ecosystem.

- Sustainability Alliances: Pursue partnerships with governmental bodies and environmental agencies to align innovative product designs with sustainability goals, thereby reinforcing consumer trust and compliance with emerging regulations.

8.4 Focus on Consumer Education and Data Security

- Transparency: Educate consumers about the safety and energy-saving benefits of AI-enabled appliances. Increased transparency into data collection and use can alleviate privacy concerns.

- Compliance: Invest in robust cybersecurity measures and adhere strictly to data privacy regulations (e.g., GDPR) to build consumer confidence and mitigate market hesitation regarding smart technologies.

8.5 Embrace Multi-Channel Distribution

- Omnichannel Retailing: Leverage both online and offline channels to capture market segments that prefer tactile in-store experiences and those who value convenience. Emerging trends indicate that offline outlets still capture around 68% of the overall appliance market, while online channels continue to grow.

- Financing Options: Provide flexible financing and leasing structures to address the high initial cost barrier, making premium appliances more accessible to a broader consumer base.

9. Conclusion and Summary of Key Findings

AI-enabled electrical home appliances are reshaping the landscape of domestic technology. The convergence of AI, IoT, and energy efficiency is driving a paradigm shift in how appliances function and how consumers interact with them. As the market is forecasted to witness continued robust growth, manufacturers and stakeholders must navigate several challenges while harnessing the opportunities presented by enhanced technology.

Key Findings

- Rapid Innovation:

• AI innovations are now integrated into smart ovens, refrigerators, laundry systems, and indoor smokers.

• These innovations include features like Cookcam™ AI, adaptive smart inventory tracking, and predictive wash/dry cycles. - Regional Dominance:

• Asia-Pacific leads the market, driven by rapid urbanization and rising incomes.

• North America and Europe remain strong due to advanced smart home adoption and stringent energy efficiency regulations, respectively. - Growth Projections:

• The global market is projected to grow from USD 747.64 billion in 2025 to over USD 1.11 trillion by 2030.

• AI-enabled appliances are set to capture an increasing share, rising from 18% to 35% as consumers embrace smart, energy-efficient solutions. - Challenges:

• High initial costs, supply chain challenges, and privacy concerns are notable hurdles.

• Manufacturers must invest in cost-effective production strategies, localized manufacturing, and robust cybersecurity measures. - Strategic Suggestions:

• Emphasize R&D for edge computing and continuous software enhancements.

• Form strategic partnerships to enhance ecosystem connectivity and to customize products regionally.

• Empower consumers with clear information and flexible financing models.

Summary Table of Key Insights

| Aspect | Summary |

|---|---|

| Market Size & Forecast | Global market to grow from USD 747.64B in 2025 to over USD 1.11T by 2030 with AI-enabled products increasing from 18% to 35% share. |

| Key Innovations | Integration of AI in smart ovens, refrigerators, laundry systems, and indoor smokers; continuous software updates enhance functionality over time. |

| Regional Dynamics | Asia-Pacific leads (~38% share), followed by North America (~22%) and Europe (~18%), with emerging markets in Middle East and Africa showing high CAGR (~7.7%). |

| Main Growth Drivers | Energy efficiency, smart home ecosystem integration, rapid urbanization, and rising disposable incomes. |

| Challenges & Mitigations | High initial investment, supply chain vulnerabilities, and data privacy concerns; addressed through financing models, localized production, and cybersecurity. |

| Strategic Recommendations | Increase R&D investment, pursue regional customization, build strategic partnerships, focus on consumer education, and enhance distribution channels. |

Final Remarks

The period from 2025 to 2030 represents a pivotal window for the AI-enabled electrical home appliances market. As manufacturers continue to integrate advanced AI functionalities, the industry stands on the brink of a technological revolution that enhances energy efficiency, user convenience, and product longevity. By addressing current challenges—especially around cost, supply chain resilience, and data privacy—and capitalizing on the robust growth drivers, incumbent brands and emerging players alike can create a dynamic, sustainable market that aligns with the evolving needs of global consumers.

The transformative impact of AI in home appliances is already evident in products from industry pioneers like GE Appliances and Signature Kitchen Suite. As these trends amplify, we can expect significant improvements not only in product performance but also in the overall customer experience, driving a more interconnected and efficient smart home future.

Manufacturers, governments, and technology providers must work collaboratively to support this evolution, leveraging strategic insights and technological innovations to foster an ecosystem where advanced, AI-driven appliances become an indispensable part of modern living. In summary, the next few years will be characterized by rapid technological adoption, increased cross-sector partnerships, and an unwavering focus on sustainability—factors that will undoubtedly define the future trajectory of the global electrical home appliances market.

![AI Virtual Pet Market 2025-2030: Growth Analysis & Industry Forecast [Report]](https://smartaidaily.com/wp-content/uploads/2025/03/AI-Virtual-Pet-150x150.avif)

![10 Best AI Text-to-Video Tools for Personal Projects [2025 Creator Guide]](https://smartaidaily.com/wp-content/uploads/2025/03/text-to-video-150x150.jpg)